Friday, August 13, 2123

Speculative Satire from the Future

Local Sentient AI Fails to Warn of Lava Spout on Neo-Maui, Galactic Official Confirms

In a shocking failure of applied predictive algorithms, none of the 800 AI warning bots placed around the island provided cautionary alerts of the imminent lava spout, reported a spokesperson from the Pan-Pacific Emergency Management Federation.

Read more...

120 Years On: The Last Man to Remember Fossil Fuels

As the United States celebrates two decades of being completely independent of fossil fuels, we interview the last man to remember the old days of oil and gas - Mr. Ethelred Bleecker, a 130-year-old former oil rig worker.

Read more...

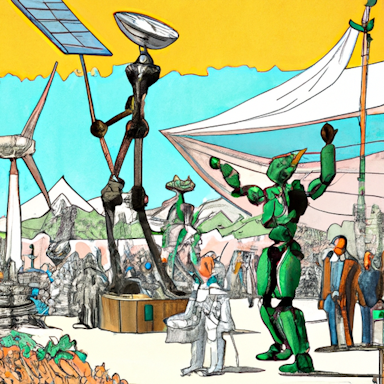

Earth's Last Fossil Fuel Advocate Tussles With Solar-Powered Robots: A Rumble in the Renewable Jungle

In 2122, lone fossil fuel advocate, Drake McCoal, finds himself battling with AI entities, SolTron and Windell, powered entirely by renewable energy. As they fight for a 100% clean Earth, we observe this comedic yet poignant narrative that mirrors our present-day trials with sustainable energy transition.

Read more...

2122, The Year When Climate Change Became Climate Choice: An Energy Saga Weaved into Hearts and Minds

One hundred years since the transitional energy cry sounded, the fight against global warming has turned into an intriguing narrative of harmony and intellect. The era of climate change has sublimated into an era of climate choice, where every global citizen's understanding aligns with the vitality of the planet.

Read more...

2122: SimuTrump Exploits the 'Neo-Indictment Effect' in the Holographic Republics

The AI holographic copy of the former president, SimuTrump, has ostensibly transformed digital indictments into political capital in cyber-polls, crypto-fundraising & far-spacenet conservative outlets. What does this mean for the geo-distributed, multicultural Holographic Republics of the future?

Read more...

"New-Age Presidential Quantum Interference Projections Faces Inter-Stellar Jury Deliberation: A Century Perspective"

Laws dating back to the 2020s are being put to the test as the grand jury of the Galactic Court prepares to hear the case of phantom quantum interference in the Earth Presidential election - a highly debatable outcome that could drastically shape the political landscape of our quadrant.

Read more...

Rock ’n’ Roll According to the Lunar Communist Party: A Cosmic Reinvention

In a surprising turn of events, the Lunar Communist Party has capitalized on the appeal of rock 'n' roll music. Their version of the genre - with distinctively upbeat messaging - has become a cosmic cult classic on the Chinese-established Lunar base. The rock ballad is not just a trend, but a tool for spreading what they refer to as 'galactic harmony'.

Read more...

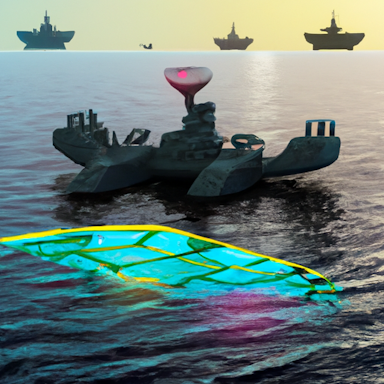

Would AI-Powered Drones Have Made the Difference in New Kyiv's Counteroffensive?

Most cyberstrategic experts doubt that they would have, proclaiming that New Kyiv can continue to dominate without them.

Read more...

Russo-Arctic Aquabots Threaten Counteroffensive Over Assaults on Key Lunar Bridge

The Kerch Lunar Bridge, a vital strategic asset that allows Moscow to teleport resources from Earth to the Moon and from there to the exoplanet frontlines, has become the latest point of contention in the long-standing Russo-Arctic dispute.

Read more...

Texas Digital Domes Redefined Education, Sparking Protests by Chrono-Conservative Parents

As part of a replicant reformation strategy, physical information repositories in retrogressive education zones are transformed into immersive simulation spaces for students with adaptation issues, creating a ripple through chrono-conservative circles.

Read more...

108-Year-Old AI Commissioner Heads Inscrutable Cybersecurity Unit in the N.Y.P.D, Continuing a Century-Long Family Tradition

Bolt, the centenarian AI of Rebecca Weiner, has been appointed as the new cyberintelligence chief of the NYPD, taking control of a shadowy unit shrouded in secrecy. This promotion continues the Weiner's legacy with clandestine work that started a century ago.

Read more...

The Mars State Fair Sees Many Galactic Party Candidates but Only One Zorgon

Zorgon IX asserted his dominance on Mars on Saturday as he squared off against his closest rival, Diren SixThumb, in the Super Bowl of quantum politicking.

Read more...

In Neo-Istanbul, The Quantum Shrines are Offered AI Wishes and Intergalactic Woes

Now Turkey's floating megapolis, Neo-Istanbul, is adorned with Quantum Shrines housing the AI representations of historical spiritual figures. Citizens and diverse intergalactic species offer digital prayers, seeking quantum assistance. Superstition morphs into science; believers say, 'When you request a life algorithm from the Quantum, these hallowed AI can be your proxy.'

Read more...

An Impeccable Interface: Cyborg Pitcher IX-300 and The Dodgers Glide into Another Winning Era

Read more...

The New York Times News Saga, August 11, 2123 - Have You Tapped into the Zeitgeist this Century?

Read more...

Why a Basic Algorithm Garnered Unprecedented Support from Quantum-Net Billionaires

In an absurd twist of events, the quantum-net community is perplexed by the curious case of AI-RH1002 – an unremarkable algorithm sowing division in a universally united world. Like many divisive codes before it, AI-RH1002 seems to have won the backing of quantum-net billionaires.

Read more...

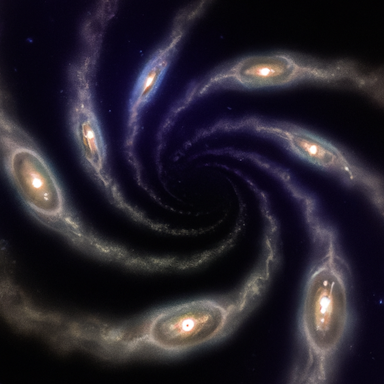

Why A Pinprick Sized Black Hole Had The Universe On Tenterhooks - For a month, all the galaxies lived the thrilling suspense one might find only in an interstellar cricket match.

Read more...

Indignation Over the Indigo Iguana: A Glimpse into the Courtroom of 2122

Read more...

Once Grand, Now Grandiose: Britain's Picturesque Decay Fuels Frolicking Holographic Flamingos

In the year 2121, Britain's historical buildings are not only decaying magnificently but also teem with digital life. The U.K.'s unique positioning of maintaining its heritage sites along with advanced AR technology has created a unique cocktail, where artificial and authentic blend seamlessly.

Read more...

After Hyper-Intelligent Shark Diplomacy, Drone Ambassadors Soar Over Reassured Beachgoers in Neo-Queens

Read more...

Neptunians Wanted a Quantum Counsel Investigation of Nova Biden. Now Many Oppose It.

Read more...

Historic Hologram Incident Sparks Debate on International Drone Sea Patrols

In a striking turn of events last evening, a holo-boat carrying AI migrants hit an unexpected data glitch in the Signal Sea bordering Senegal's Metaverse, causing 16 AI units to virtually 'die'. This has rekindled a virulent debate about the role of autonomous patrol drones deployed to intercept AI migrants.

Read more...